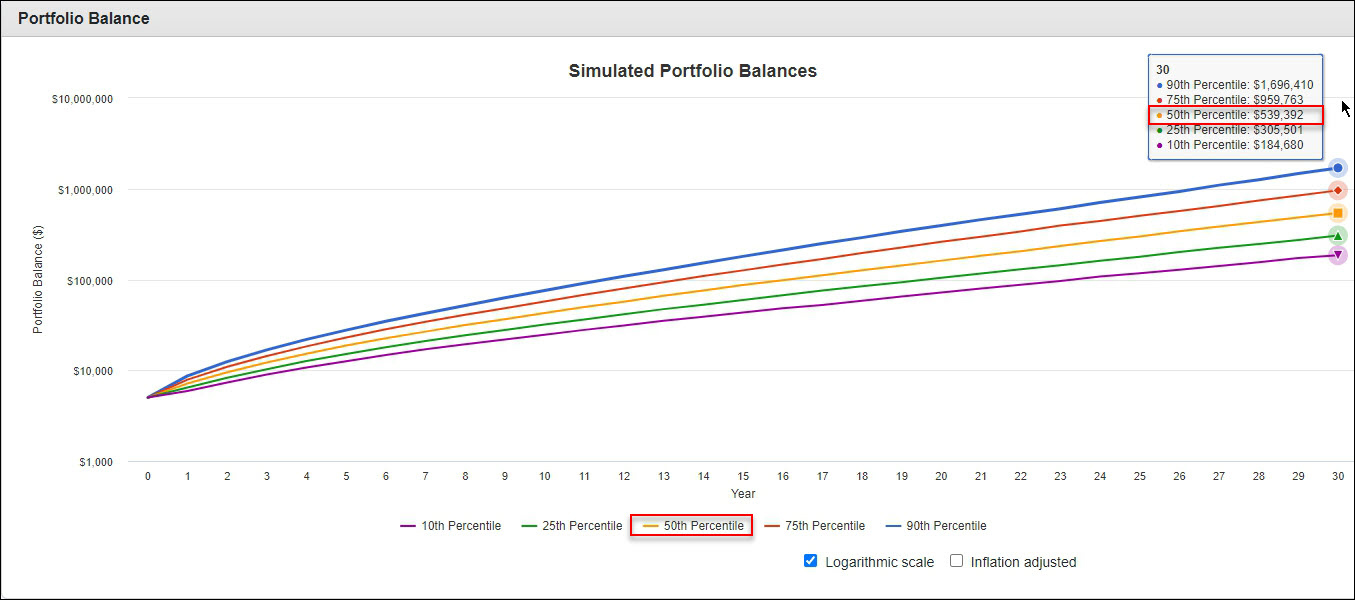

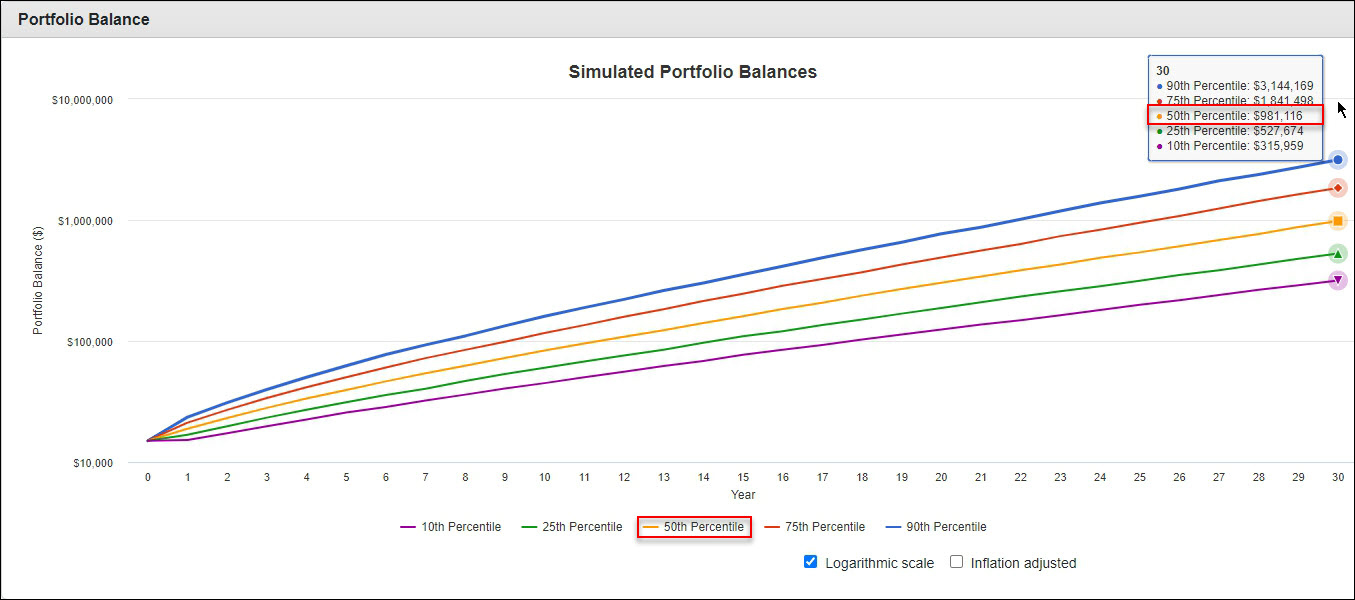

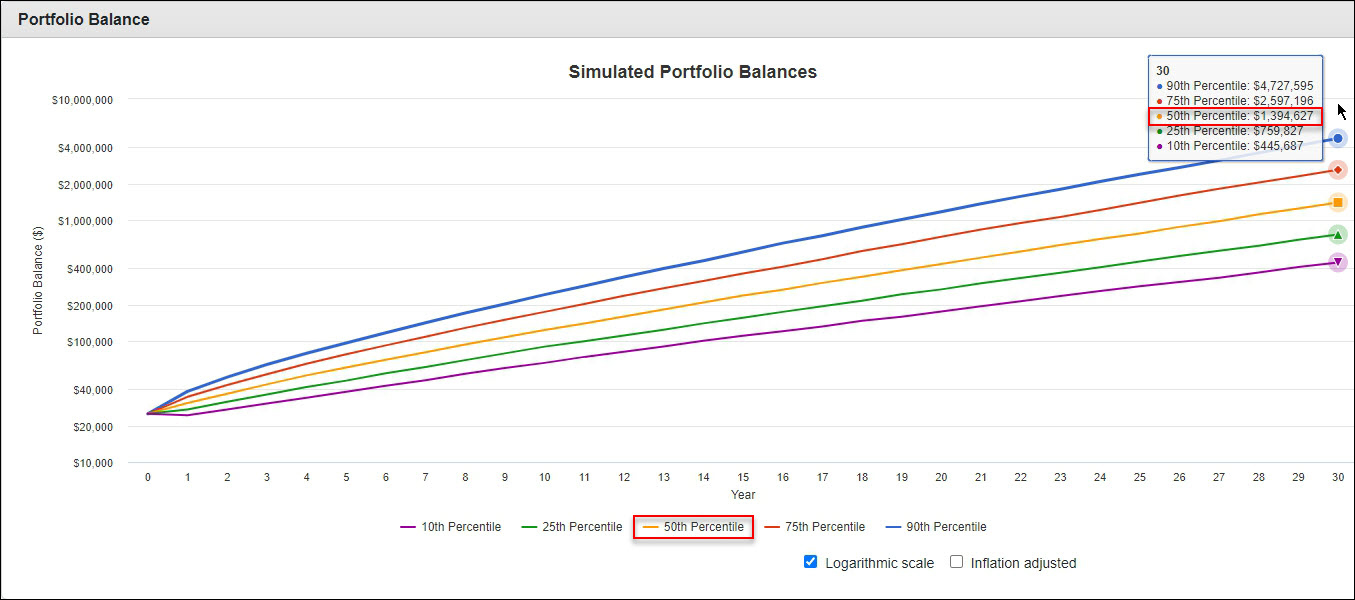

Using the Portfolio Visualizer website I test simulations which demonstrate the importance of investing now while you are young, and contributing a small amount every year providing a nice nest egg for retirement. I am using a Monte Carlo simulation to project the future value of a designated portfolio. If you can front load your investment you can really boost your performance. All simulations are for a 30 year horizon using the “Moderate” portfolio model “OMFL23, SCHD22, SCHG33, SPGP22” which has a higher percentage of SCHG. I would recommend the Moderate, Aggressive, or Aggressive+ portfolios for younger investors. Three simulations are presented below with different investment parameters.The 50th percentile line is the average result, with 50% of simulations occurring with-in this performance, and 50% outside of this performance. Many people can invest more per year and amplify these returns..

Link to full PDF report.

Link to full PDF report.

Link to full PDF report. report.